Last week, the crypto industry witnessed one of the biggest collapses ever in history. Terra protocol, which has more than 18B circulating stablecoins, was destroyed entirely in less than a week. Witnessing the collapse, I felt a strong desire to propose a new evaluation criteria that would help other algorithmic stablecoin projects to construct a more sustainable and sound system. My personal view over the collapse was that algorithmic stablecoin projects now should take care of their ecosystem in addition to the solidness of their mechanism.

Introduction

In this article, I will introduce a novel criteria that could be used in algorithmic stablecoin projects when monitoring the sustainability of their system. Specifically, this article will focus on evaluating the soundness of a stablecoin’s ecosystem. First, I will present historical examples that explain why estimating the soundness of the ecosystem is crucial for managing risk factors and constructing sustainable systems for algorithmic stablecoins. Afterward, I will give an in-depth explanation of what indices could be used to monitor the risk factors present in a stablecoin’s ecosystem. I hope the indices introduced in this report can help other protocols consider their ecosystem as an important factor for managing their protocol.

Impact of ecosystem on stablecoin stability

Stablecoin protocols intertwined with its ecosystem

Nowadays, most stablecoin projects are closely intertwined with their underlying DeFi protocols that are based on their stablecoin. First of all, protocols bootstrap demands on their stablecoin via various protocols in their ecosystem. Furthermore, they could introduce additional price stabilization measures by utilizing DeFi protocols in their ecosystem.

For example, Anchor protocol was able to create a massive demand for UST, thereby helping the Terra ecosystem expand at a rapid pace. On the other hand, stableswap pools in Curve finance are primarily used as a price stabilization measure for stablecoins by correlating the price of each stablecoin with the de-facto stablecoins in the ecosystem, which includes USDC, USDT, and DAI. Hence, the roles of the ecosystem underlying each stablecoin can be summarized in a twofold manner.

Ecosystem generates major demands for the stablecoin

Ecosystem provides front-line price stabilization measures for the stablecoin

Interpreting the Terra protocol collapse from the perspectives of Terra ecosystem

Even though there is a lot of criticism on the stabilization mechanism itself, my personal view on the protocol is that it had gone through a lot of stress testing since the very start of the protocol including the depeg event in May 2021. During that event, the price of LUNA dropped more than 70% in less than a week while UST lost its peg, dropping to less than $0.9 per UST. However, the protocol was able to successfully overcome the depeg event and restore the peg afterward. Then, what’s the core difference between the depeg event in 2021 and the collapse in 2022?

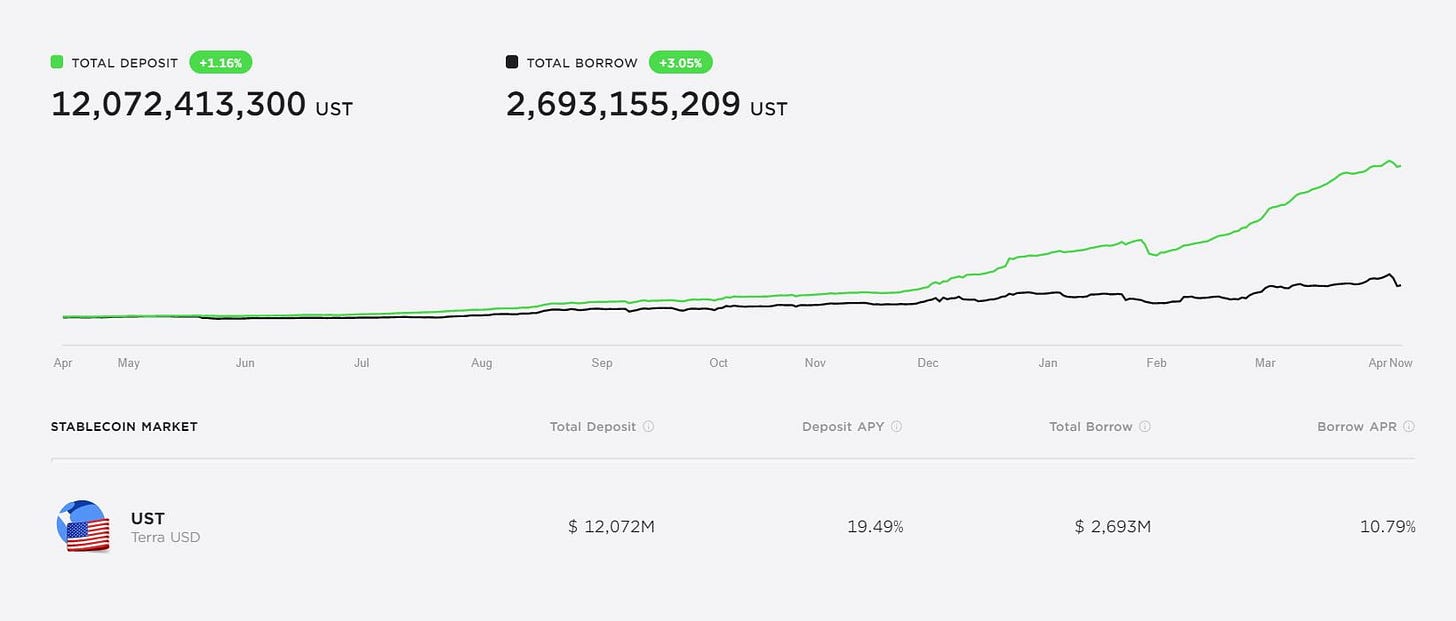

Enter Ecosystem Soundness. During last year's depeg, only around 300M UST out of 1.7B total supply were deposited to Anchor protocol. This means that there was no extreme concentration of UST demands on a single DeFi protocol. However, in 2022, around 14B out of 18B total supply was deposited in Anchor protocol due to the 20% interest rate. In other words, the UST ecosystem became heavily reliant on the Anchor protocol.

The above figure illustrates the demand curves for a stablecoin based on the soundness of its underlying ecosystem. If a stablecoin has many healthy use-cases and utilities, it will have a smooth slope. This means that even if some use-cases of that stablecoin were to be severely impacted, people would still be able to utilize the currency elsewhere. Thus, the price of that stablecoin would not be significantly affected by a single event.

Compare this with the figure on the right, which depicts the demand curves for a stablecoin with an unhealthy ecosystem. In this scenario, the stablecoin’s demand relies heavily on a single use-case. Therefore, whenever that use-case is severely affected, people would be more likely to find the stablecoin valueless and start dumping the stablecoin, triggering death spirals in the case of an algorithmic stablecoin. This is exactly what happened to the Terra protocol in May 2022.

Having lost faith in UST’s price stability after witnessing the depeg during the second week of May, people started to doubt the safety of their assets deposited in the Anchor protocol. What made the situation worse was that there weren’t any mechanisms in place that could stop people from withdrawing large amounts of UST at once. As a result, around 8B UST deposits were withdrawn from Anchor protocol in just a few days.

No algorithmic stablecoin protocol could have defended its peg during an event where around half of its stablecoin supply turned into sell-pressure. In summary, because UST demand was extremely concentrated on the Anchor protocol, when the stability of the Anchor protocol was affected, UST demands shrunk at an unprecedented pace, leading to one of the largest bank runs in history.

Interpreting the Iron finance collapse from the perspective of ecosystem soundness

In fact, there is another noteworthy stablecoin collapse event in the history of the crypto industry. In June 2021, Iron finance, a fractionally-algorithmic stablecoin protocol with more than 2B in total supply, saw its value plummet to nothing in less than a day. Prior to the fall, Iron finance was rewarding IRON or TITAN LP providers (IRON was the stablecoin of the protocol and TITAN was the seigniorage-share token) with extremely high APY level with TITAN inflation. On June 9th, some whale dumped its TITAN tokens and TITAN prices started to collapse. It didn’t take long for the public to see the price of TITAN going down to $0.

What was the problem here? Iron finance neglected the fact that most of the TITAN holders in the market consisted of mercenary holders who were just in it for the high APY, with no interest in the protocol’s future. Since the price of TITAN was already in an unstable state due to the ridiculously high inflation rate, a small price drop was enough to trigger massive TITAN dumps. The Price downfall in the seigniorage-share token made the price of the stablecoin unstable again. This in turn created a negative feedback loop where TITAN prices fell drastically due to the massive minting of TITAN that occurred in order to restore the peg.

In retrospect, Iron finance neglected the fact that its ecosystem was in a highly volatile stance, where even a small event could easily trigger its collapse.

Criteria for evaluating ecosystem soundness of the stablecoin

Establishing a evaluation direction

There are dozens of other examples where stablecoins collapsed due to factors that arose from the ecosystem. On that note, I want to list the reasons why managing risk factors in the ecosystem is important in a more direct manner: 1) Impact on a stablecoin’s utility could generate huge shrinkage in its demand, causing bank run events that the protocol cannot absorb, 2) Some components in the ecosystem should act as the protocol’s frontline of defense during such events, by absorbing sell-off pressure. With respect to the second point, I did not explain it in detail in this article. However, you could easily find other articles pointing out that there weren’t sufficient liquidity measures to absorb the massive sell-pressure from Anchor protocol.

Long story short, stablecoin protocols should monitor whether

Demands for their stablecoin stand on healthy and solid ground

Enough shock absorbing capability exists in the ecosystem in addition to the protocol itself

Soundness of stablecoin demands

Because stablecoin protocols, by definition, must guarantee a $1 value for each coin, protocols should consider every stablecoin minted as a liability to their protocol. If so, one of the most dangerous scenarios that can occur is a bank run, where a massive number of stablecoin holders try to redeem their stablecoins. For algorithmic stablecoin protocols, this would lead to a death spiral.

One crucial measure that can be taken to help prevent such a crisis is to make the stablecoin usable in a wide range of applications. Then, even if some DeFi protocols are destroyed, people would still have faith in the stablecoin’s value. In this respect, the following aspects can be monitored.

Distribution of circulating supply

Protocols should monitor whether their stablecoin is evenly distributed among multiple protocols for multiple purposes. If supply is biased to a certain domain or a certain protocol, the protocol is more likely to encounter a bank run when that use-case is affected by external factors. To avoid a high concentration on distribution, the protocol could incentivize developers in the ecosystem to construct other utilities and use-cases. If the protocol is providing governance tokens as inflation rewards, it could adjust the distribution ratio so that other utilities could attract the concentrated distribution to a wider range.

Sustainability of stablecoin utilities

Protocols should also closely monitor the major utilities of their stablecoin and see whether they are sustainable. For example, if most of the total supply is concentrated on a protocol that attracts holders with unsustainably high yields, it is highly likely that the protocol will not be able to maintain its utilities in the long-term. Likewise, protocols could monitor whether there are protocols in the stablecoin ecosystem that are likely to lose their value. If so, This means that a certain amount of sell-pressure could arise from that protocol and therefore the stablecoin protocol should be prepared to absorb that sell-pressure.

Ecosystem’s capability of absorbing sell pressure

Maximum sell-pressure that could arise

In calculating price stability, protocols should assume the worst-case scenario where all token holders are willing to dump his/her stablecoin. This is especially true for algorithmic stablecoins that lack the backing for its stable price, as one can see from the Terra Collapse.

Protocols could monitor and aggregate the amount of directly sellable stablecoins in its ecosystem. This includes stablecoin deposits that can be instantly withdrawn by users, as well as stablecoins that are sitting inside users’ wallets. These statistics could help protocols calculate the maximum price depeg during a worst-case scenario.

Sell-pressure absorption capability

Nowadays, stablecoin protocols are endeavoring to construct a high level of liquidity for their stablecoins and seigniorage-share tokens in the market. To be specific, they are accumulating a high level of liquidity in Curve pools where they can peg their stablecoin to more stable coins like 3 Pool tokens.

Stablecoin projects could monitor established liquidity in those curve pools or uniswap v3 pools where a concentrated liquidity algorithm is deployed. Furthermore, protocols could calculate the protocol-owned liquidity out of the liquidity constructed in those AMM pools.

This similarly applies to the liquidity of seigniorage-share tokens in the market, as this estimation is highly correlated to the likeliness of death spiral events where the price of seigniorage-share tokens falls severely during the market downside.

With the maximum sell-pressure estimation and protocol-owned liquidity in AMM pools, protocols could estimate the maximum level of price fall that can occur during black swan events. Based on this estimation, protocols could prepare further sell-pressure absorption capability by incentivizing LP providers.

Conclusion

In This article, I have introduced a novel criteria for evaluating the sustainability of stablecoin projects. In essence, I strongly urge stablecoin projects to consider their ecosystem as a critical factor that could trigger the collapse of their system. In this article, I have explained how ecosystems have directly caused the notable collapses in stablecoin history. Furthermore, I have proposed some helpful features that could be used to monitor risk factors in the stablecoin ecosystem.

A non-Ponzi, algorithmic stable coin should essentially be a distributed mechanism for gathering and maintaining appropriate deposits for the stablecoin supply issued.

In traditional banking, there are centralized circuit-breaker mechanisms to prevent the system from collapsing in times of extreme stress. For instance there can be a limit placed on withdrawals. This is a necessary part of the system. Without that withdrawals can spiral. $LUNA / Terra didn't have those mechanisms. In fact, under stress they increased the available rate of withdrawals, making the problem worse not better. This is a kindergarten level mistake. That's why it failed so badly. They shot themselves in a foot and then kept on shooting.

In a distributed system, that kind of limiting cannot be imposed centrally, but rather has to be maintained algorithmically. This is a huge challenge as often the community will have to deal with unknown unknowns. To me it seems that the best course of action would be for the algorithm to behave overly-conservatively, overreacting to stress, rather than underreacting. Then the community would be able to reverse or adjust some of those reaction via voting process. However the tough thing about it is that what is best for everyone will not be best for every single person individually. Essentially a large-scale Prisoner's Dilemma.

For now at least, USDN seems to be doing better or "less worse" than Terra. My understanding is that it's mainly due to limits imposed on withdrawals and due to rate limiting of the algorithm (NSBT is prohibitively expensive at the moment). Not sure if they will survive, but at least they seem to be collapsing much more slowly.

In the article you mentioned placing limits on withdrawals and always assuming worst-case scenario. This to my understanding will be inefficient and will effectively lead to over-collateralization. No central bank would ever conduct their policy this way, it's wasteful. But they don't have to - if everyone indeed decided tomorrow to withdraw all their money, withdrawal limits would be swiftly enacted, until the pressure lessened and the underlying reasons for the panic went away. It is much more efficient to design monetary policy for a reasonably probable situation and then have extreme measures for extremely rare events. Conducting monetary policy like every day is a Black Monday is moving back thousands of years in fiscal policy, towards a much less efficient economy.